Pie OS: From $10m to $350m in 5 Years

Over five years span, I led the design and strategy behind Pie OS, Pie Insurance’s proprietary policy lifecycle software. This 0-to-1 ecosystem scaled operations from $10 million to $350 million in total written premium by making complex insurance workflows as Easy as Pie while providing Pie complete control over their technology and processes.

TL;DR

- I designed Pie’s Partner Portal enabling 5-minute quotes, instant binding, and policy servicing—driving a 2900% increase in submission volume and 900% growth in appointed agencies over 5 years.

- I simplified complex linear rating algorithms into a single-page interface for Pie’s Underwriter Rater, boosting underwriter efficiency by 3x.

- I scaled Pie’s Policy Management System with a modular UI architecture, cutting $1m in annual costs and enabling multi-state, multi-line, and multi-carrier growth.

Partner Portal: Redefining the Agent Quoting Experience.

In 2019, Pie was rapidly onboarding agents but relied on a glorified Google Form with unique URLs for each agency, minimal auto-decisioning, and a process that quickly devolved into email inboxes after submission. Far from Easy as Pie, it was a logistical nightmare in need of a scalable solution.

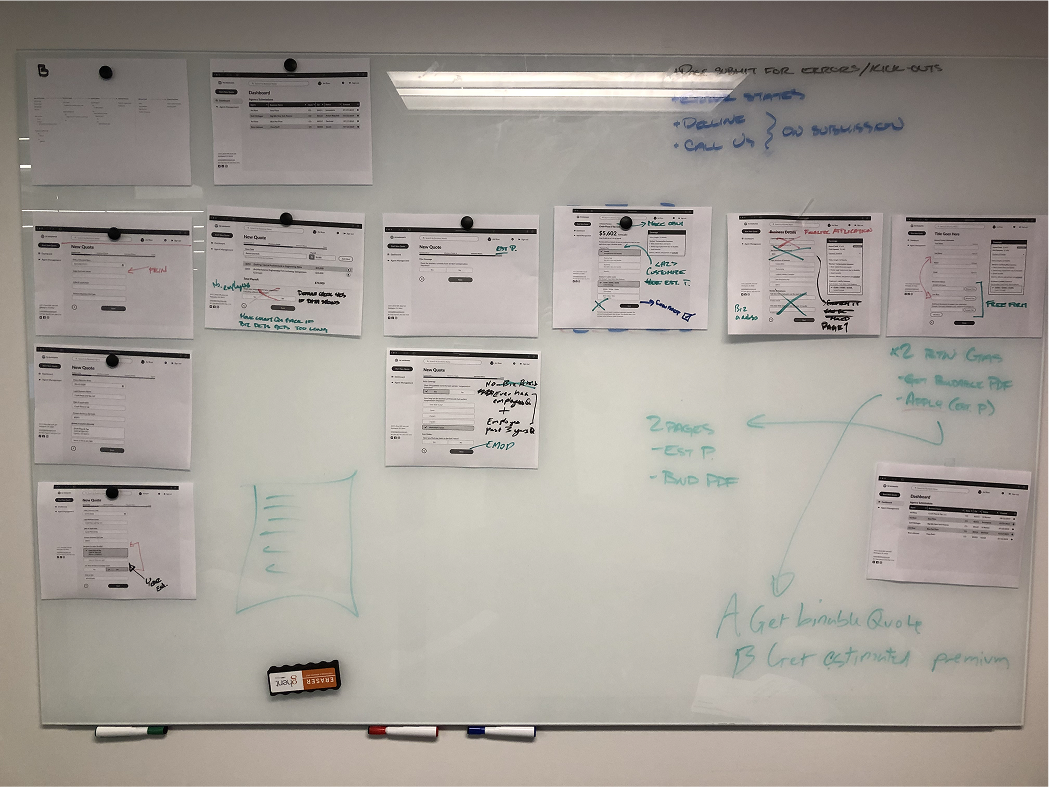

To understand the insurance submission and rating process, I began by interviewing Pie underwriters, sales reps, and business development managers. These conversations revealed underwriting priorities, the agent journey, and competitive nuances, shaping the quote flow data collection hierarchy.

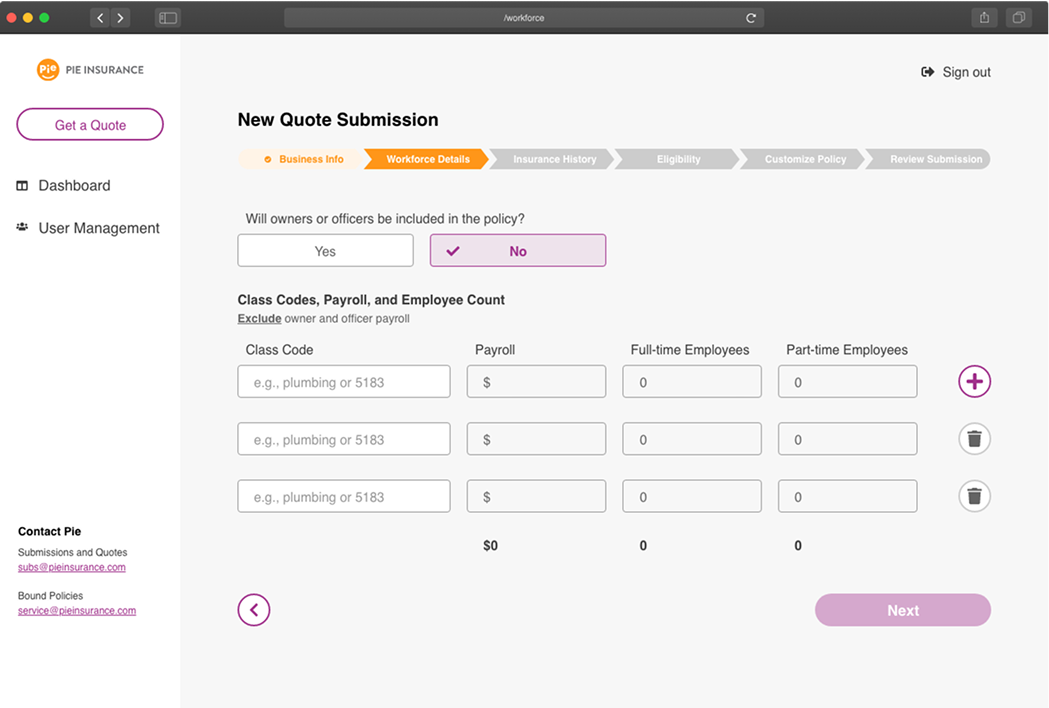

I implemented a progressive disclosure design strategy to simplify the interface, reduce cognitive load, and focus on getting the agent a decision asap. This led to nested question sets and real-time declinations, ensuring users were only asked what was necessary. UI components like pick-lists, drop-downs, and class code lookups streamlined inputs, enhancing speed and usability.

I conducted virtual feedback sessions with 10+ agents using interactive design prototypes to gather usability insights, assess design effectiveness, and understand feature importance. I compiled the results and presented the findings to my Agile team, helping to inform MVP feature prioritization.

Guided by the research and business goals, I created final designs for dev handoff. With no design system beyond basic typography and colors, I defined patterns and built reusable components concurrently, accelerating my design velocity. These became the foundation for Pie-brary, the design system I would later develop and scale. View the final design prototype.

Making Quoting Easy as Pie.

Pie’s Partner Portal officially launched in April 2020 to resounding success. Faster, cleaner, and easier to use than competitor portals, it quickly became a favorite among agents, driving a 2,900% increase in submission volume and 900% growth in appointed agencies.

In the years that followed, continuous improvements reinforced its status as a top choice for agents, enabling fast 5-minute quotes. Enhancements like real-time business look-ups, instant binding, and multi-line quoting further elevated Pie’s Partner Portal as one of the industry's most preferred quoting systems.

Underwriter Rater: Improving the Risk Assessment Experience.

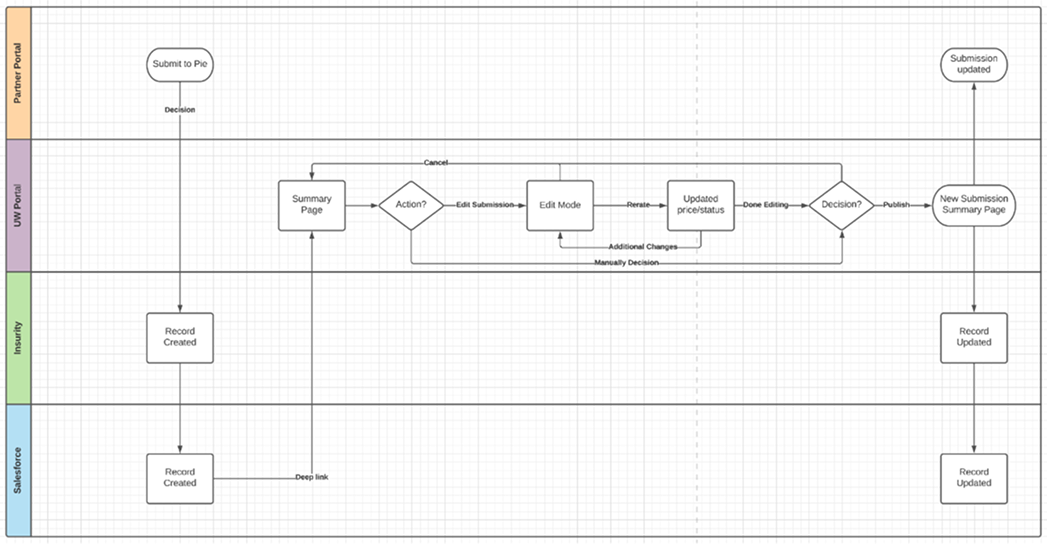

With Partner Portal live, the focus shifted to optimizing underwriting workflows. Underwriters relied on Insurity, a third-party policy system that was slow and cumbersome. The new system needed to streamline risk assessment while seamlessly processing submissions from Partner Portal and Pie’s API.

I began by shadowing underwriters to observe their risk assessment process firsthand. While approaches varied, the core need was clear: the ability to adjust inputs, view pricing and decisions in real time, and confirm or reject changes. These sessions also revealed key insights into information hierarchy, frequently used fields, and essential overrides.

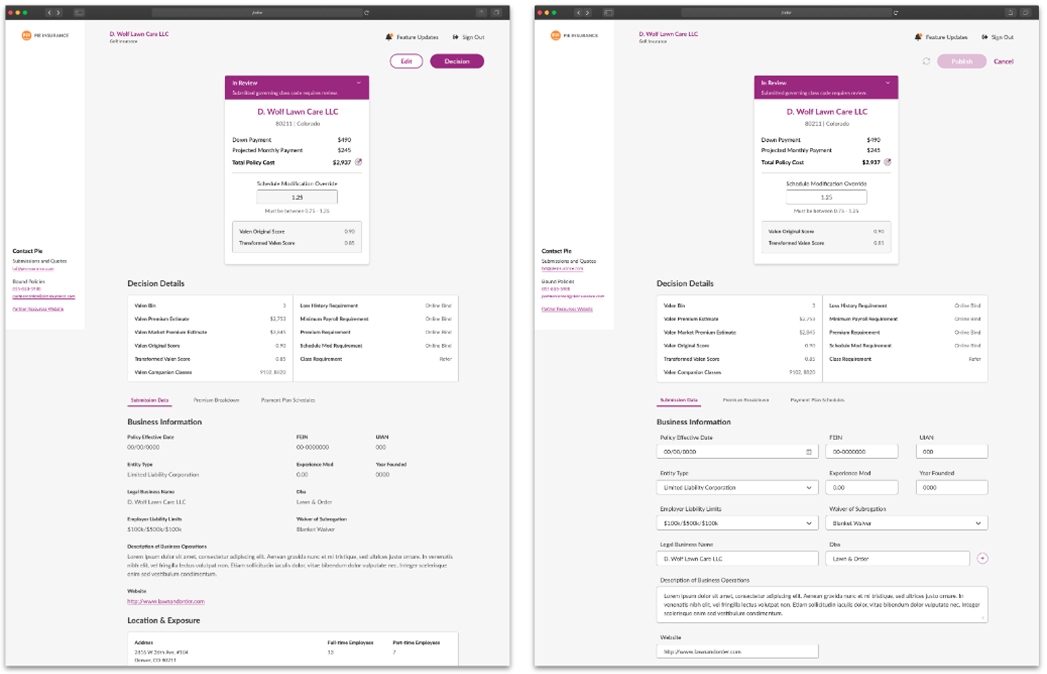

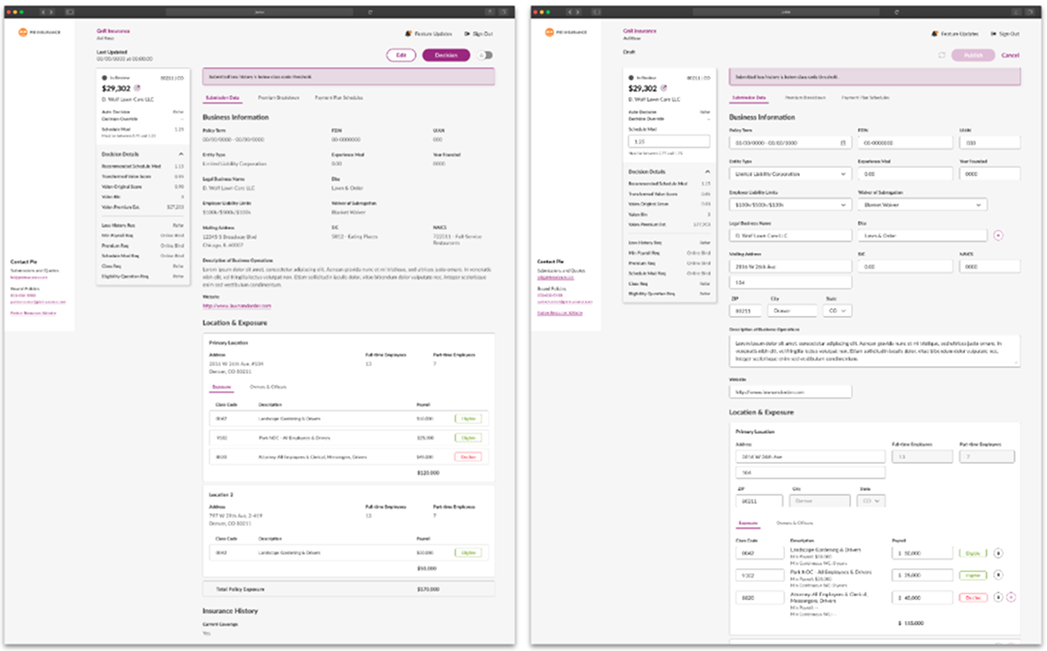

To truly improve on Insurity, I believed a single-page interface would provide the fastest way to review, rate, and decision submissions. Condensing vast amounts of data into a clear, readable format while simplifying complex, linear rating decisions required relentless iteration, detailed data mapping, and countless $6 lattes, but it all came to fruition in early 2021 with the release of UWR version 1. View the v1 design prototype.

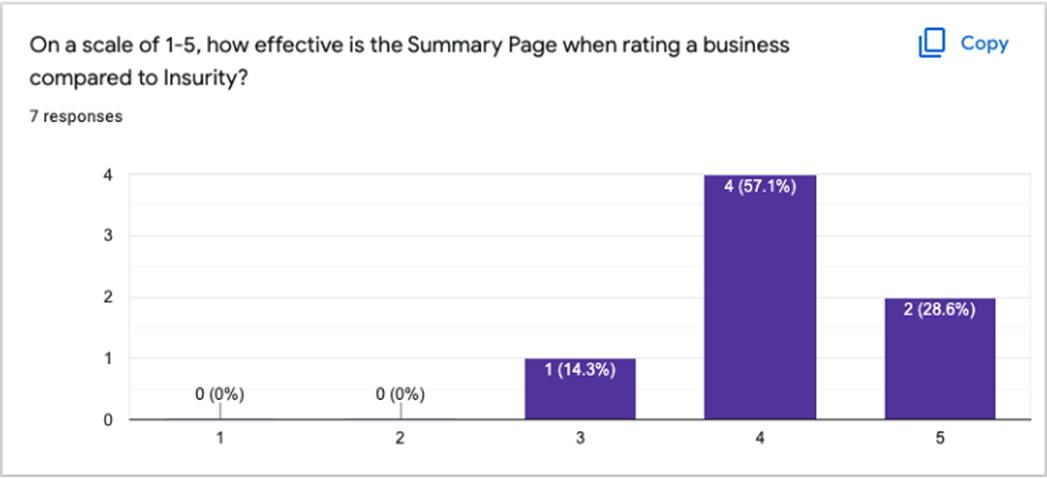

Following the release of v1, I spent countless hours reviewing behavioral patterns, watching session replays, and collecting user feedback to assess the effectiveness of the single-page layout, identify pain points, and uncover opportunities for further efficiency.

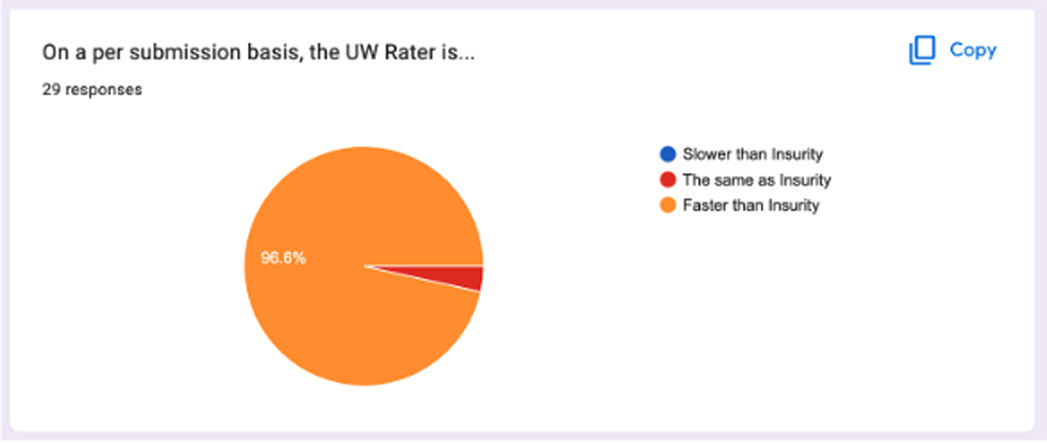

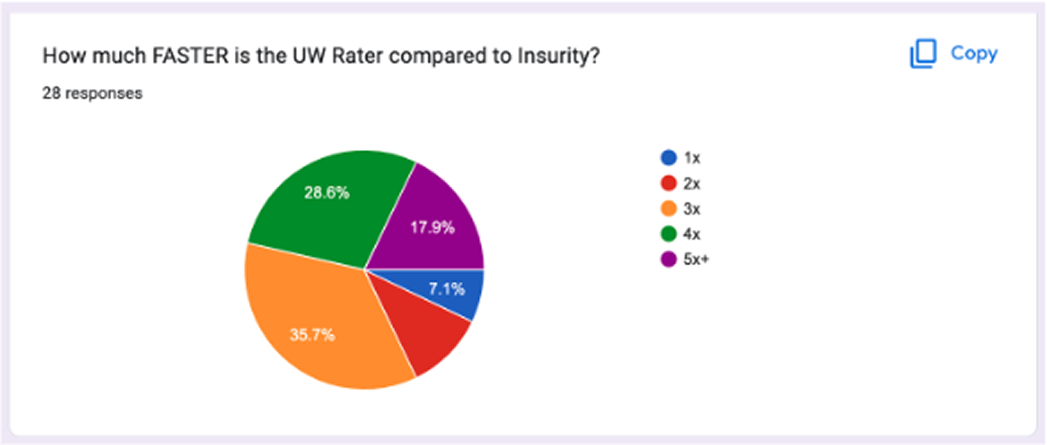

Research confirmed my single-page interface was 3–5x faster than Insurity, but session replays and user feedback highlighted areas for improvement, including error messages, information hierarchy, and excessive scrolling. Underwriter Rater v2 addressed these by fixing top-line information and controls on the page, and improving error communication. View the v2 design prototype.

A Smarter, Faster Rating Process.

Pie’s Underwriter Rater transformed complex rating algorithms into a streamlined single-page interface, increasing underwriter efficiency by 3x and becoming a preferred tool among the team.

Over the following years, continuous improvements reinforced its ability to review, rate, and decision submissions with speed and accuracy. Enhancements like task-based flows, automated lookups, and multi-state quoting solidified it as both a company differentiator and a key driver of operational efficiency.

Policy Management System: Enabling Complete Control of the Policy Lifecycle

The final step to Pie’s independence—and eliminating a $1 million annual contract with Insurity—was building post-issuance policy management capabilities. Unlike the original objective of UWR, this system needed to support Pie’s complex existing operations and scale for future growth, including multi-state, multi-line, and multi-carrier business.

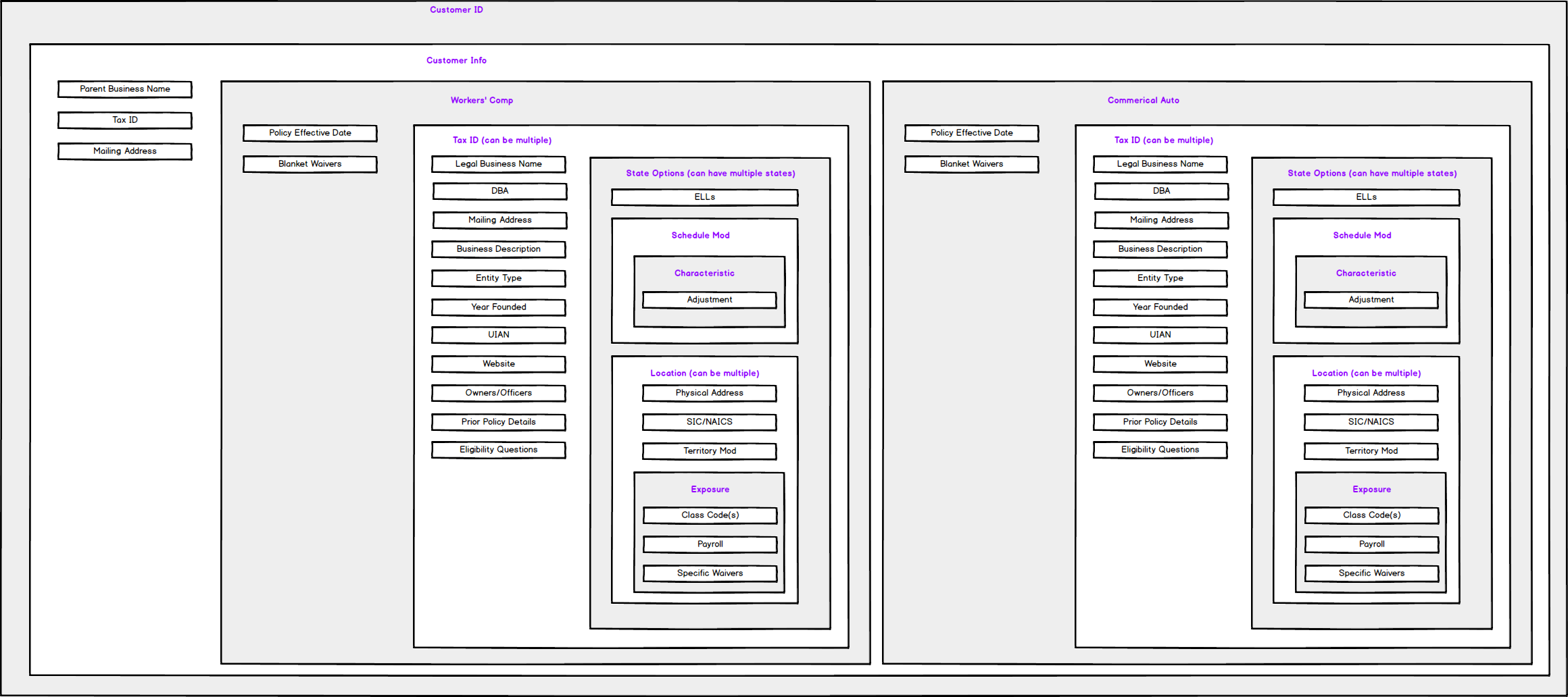

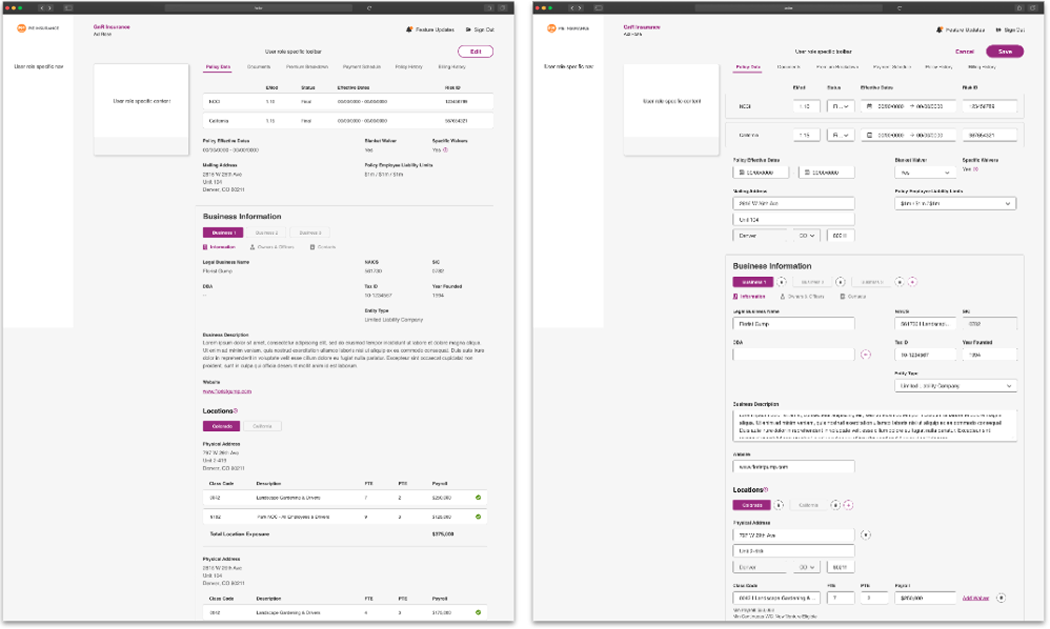

After my promotion to Lead UX Designer, my role shifted to setting the strategic vision, while the incredibly talented Ken Ligrani handled execution. Building on UWR’s successful single-page UI, I hypothesized that the architecture could scale to handle policy management use cases. To validate this, I conducted extensive data mapping to ensure the architecture aligned with Pie’s long-term vision.

My data mapping efforts confirmed the scalability of the single-page design, ensuring it could evolve with Pie’s growing ambitions. I created a master design architecture file that standardized page structures across the entire policy lifecycle—from new business acquisition and issuance to servicing, audit, and renewals—serving as the blueprint Ken worked from. View the master file prototype.

Modular Design Architecture

Pie’s Policy System scaled seamlessly within the modular UI architecture I designed, eliminating a $1 million annual cost and enabling multi-state, multi-line, and multi-carrier expansion.

As data complexity grew, UI elements like drawers, toggles, and hover states were introduced to minimize cognitive load while supporting continuous business growth. These enhancements empowered Pie to maintain full control over its technology and future scalability.

From 0 to 1: Transforming Pie’s Technology and Driving Growth.

By leveraging a user-centric design process and modular architecture, I delivered a scalable 0 to 1 ecosystem that modernized Pie’s technology, drove unprecedented growth, and gave the company full control over its platform, all while delivering experiences that are Easy as Pie.

At the time of my departure, Partner Portal remained an industry-leading quoting platform, earning an InsurTech Innovation Award in 2022. Underwriter Rater continued to drive operational efficiency while scaling alongside the Policy Management System as Pie transitioned from an MGA to a licensed insurance company. Pie OS became a cornerstone of investor demos, showcasing its value in shaping the company’s future.